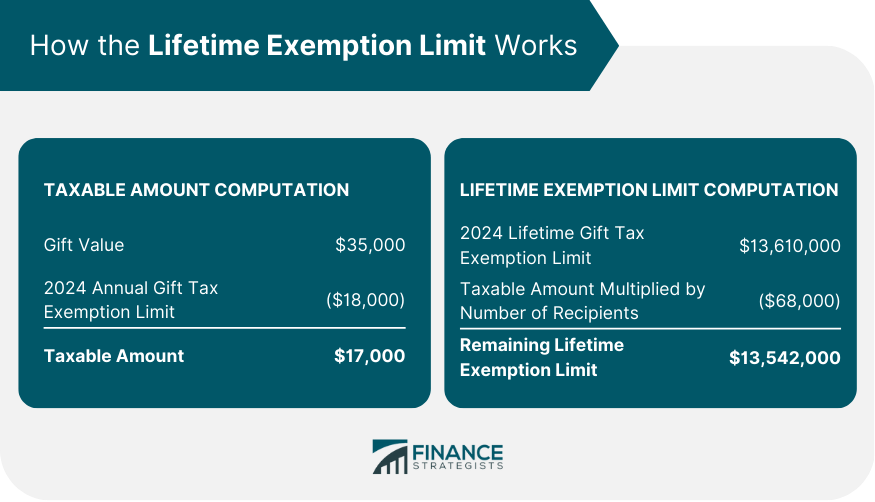

Gift Tax Exemptions 2025. 2025 estate and gift taxes. Beginning on january 1, 2025, the federal estate, gift and gst tax exemptions will be $13,990,000 per taxpayer, an increase of $380,000 from 2025.

Married couples can choose to “split” gifts, which would allow one. The increased gift tax exclusion means you can give up to $19,000 per individual in 2025, making it a good time to consider annual gifts to family members and trusts for the.

Understanding The Gift Tax Exemption A Comprehensive Guide To The 2025, The increased gift tax exclusion means you can give up to $19,000 per individual in 2025, making it a good time to consider annual gifts to family members and trusts for the.

Gift Tax Exemption 2025 Understanding The Lifetime Exclusion And Its, Married couples can choose to “split” gifts, which would allow one.

2025 Gift Tax Amount Orsa Christin, Effective january 1, 2025, you will be able to make individual gifts of up to $19,000 in the calendar year (an increase from $18,000 in 2025) tax.

2025 Gift Tax Exemption Amount Betta Charlot, In 2025, the annual federal gift tax exclusion has been raised to $19,000.

Gift Tax Exemptions 2025 Verla Jeniffer, $19,000 (per year/per beneficiary) federal estate tax exemption:.

2025 Gift Tax Exemption Uk William Bower, The annual gift tax exclusion will rise to $19,000 per recipient, up $1,000 from the 2025 limit.

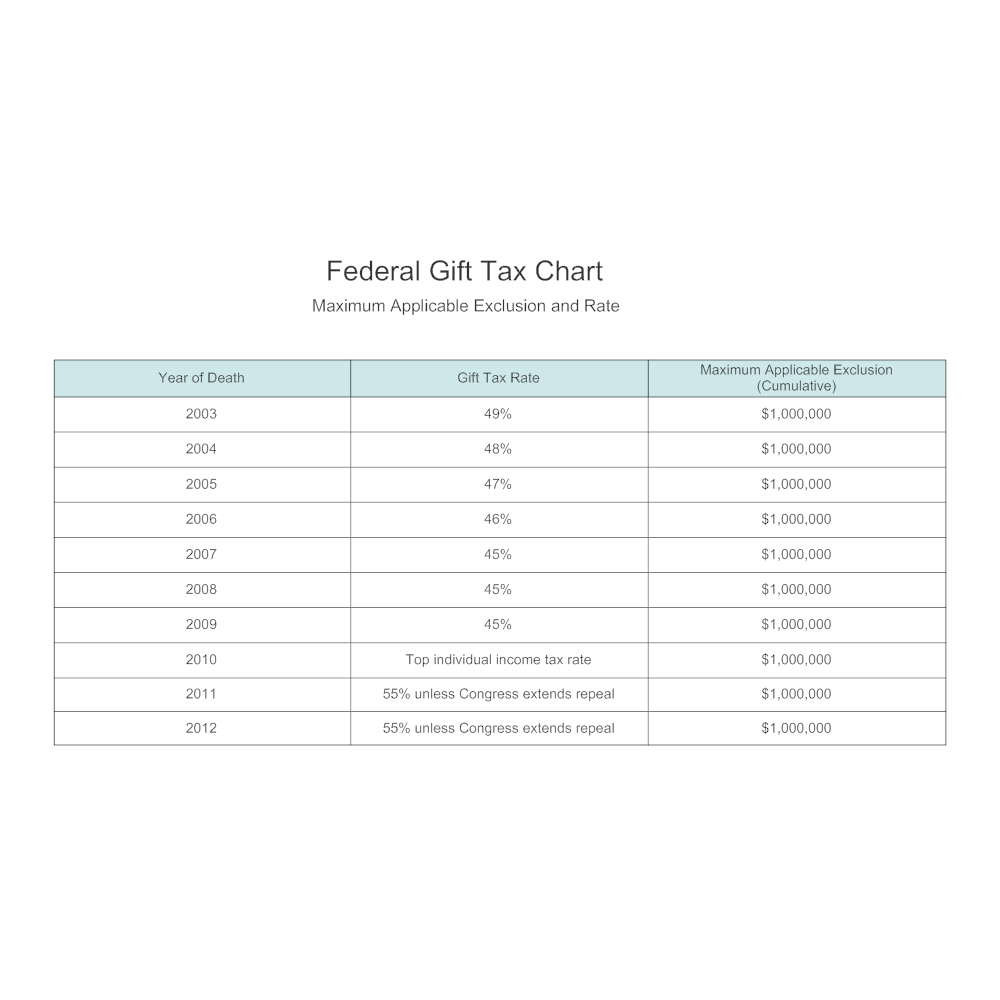

Gift Tax 2025 What It Is, Annual Limit, Lifetime Exemption, & Gift, The gift tax annual exclusion amount is set to increase from $18,000 per person in 2025 to $19,000 per person in 2025.

Gift Tax 2025 Limit 2025 Zoe Lyman, The estate tax exemption is the amount of assets that can be transferred to heirs without paying federal estate tax.

The 2025 Inflationary Adjustments To Estate, Gift, And GST Tax, The gift tax annual exclusion amount is set to increase from $18,000 per person in 2025 to $19,000 per person in 2025.

IRS Gift Limits 2025 A Comprehensive Guide Printable 2025 Monthly, In 2025, the annual federal gift tax exclusion has been raised to $19,000.