Fsa Minimum Contribution 2025. Like the 401(k) limit increase, this one is lower than the previous year’s increase. If you are new to dartmouth and.

An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll deductions during the 2025 plan year. An fsa contribution limit is the maximum.

Fsa Daycare Limits 2025 Elaina Stafani, The irs recently announced that flexible spending account contribution limits are increasing from $3,050 to $3,200 in 2025. The irs confirmed that for plan years beginning on or after jan.

Fsa 2025 Contribution Limits 2025 Calendar, The irs set a maximum fsa contribution limit for 2025 at $3,200 per qualified fsa ($150 more than the prior year). How do fsa contribution and rollover limits work?

FSA contribution How do I contribute? All About Vision, If you are new to dartmouth and. The irs has increased the flexible spending account (fsa) contribution limits for the health care flexible spending account (hcfsa) and the.

2025 FSA & Retirement Plan Contribution Limits (3) San Rafael Employees, In 2025, the fsa contribution limit increases from $3,050 to $3,200. For 2025, the minimum deductible for a family health plan will be at least $3,200, up from $3,000 in 2025.

IRStable Wilke CPAs & Advisors, How do fsa contribution and rollover limits work? The fsa contribution limits increased from 2025 to 2025.

How Much Fsa Can I Roll Over To 2025 X2023C, Explore 2025 contribution limits for hsas and fsas, and learn how hr can optimize employee benefits with ongoing communication and diverse outreach. The irs confirmed that for plan years beginning on or after jan.

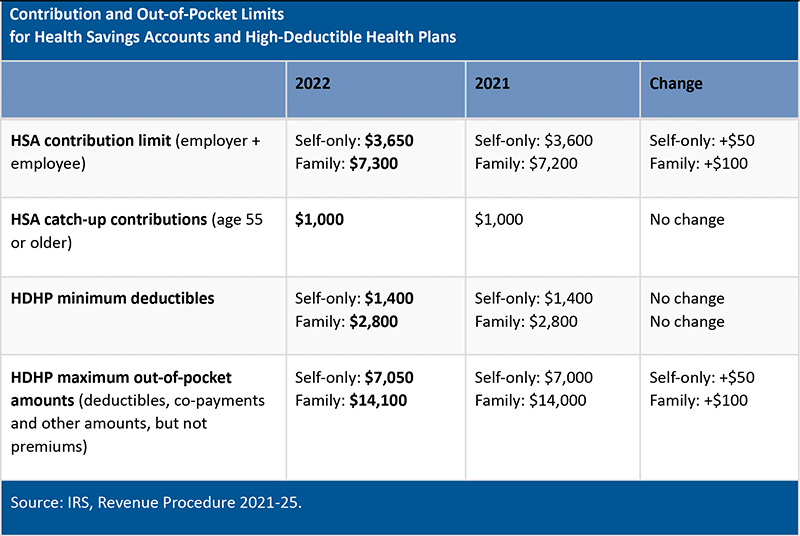

2025 HSA Contribution Limits Claremont Insurance Services, The internal revenue service (irs). The irs confirmed that for plan years beginning on or after jan.

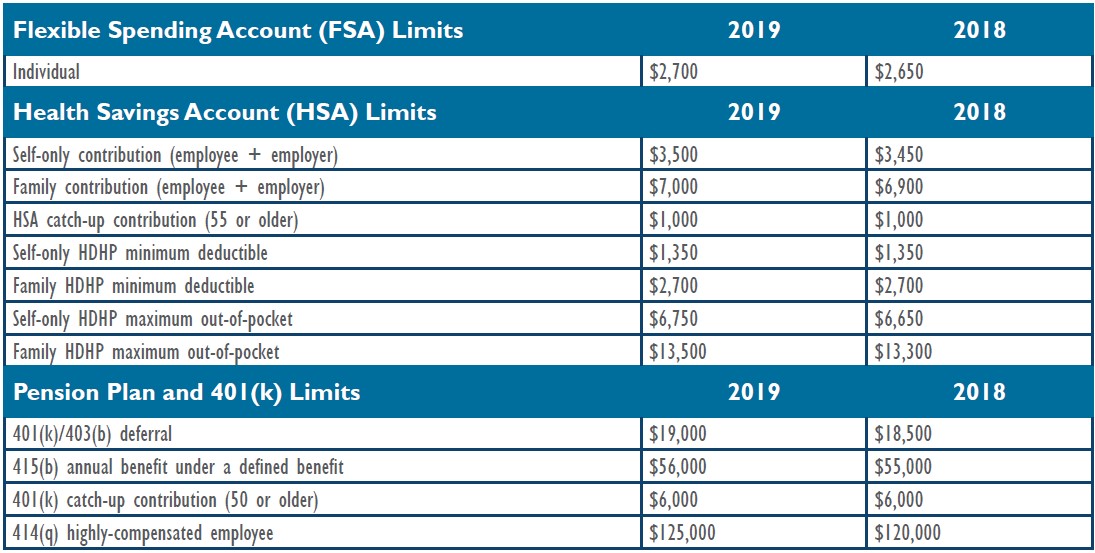

2019 FSA and HSA Contribution Limits, The internal revenue service (irs). Employees can now contribute $150.

2025 Fsa Amounts 2025 Calendar, The irs set a maximum fsa contribution limit for 2025 at $3,200 per qualified fsa ($150 more than the prior year). The fsa contribution limits increased from 2025 to 2025.

2025 Fsa Rates 2025 Calendar, If you don’t use all the funds in your account, you may. Irs announces fsa contribution cap for 2025.