California Veteran Property Tax Exemption 2025. Veterans with a 100% disability rating are fully exempt from property taxes. The california authorize multiple property tax exemptions for veterans amendment may appear on the ballot in california as a legislatively referred constitutional amendment on.

California homeowners can reduce their assessments by $7,000 by claiming a homeowners exemption, but almost a third in los angeles. One for veterans and one for disabled veterans.

California homeowners can reduce their assessments by $7,000 by claiming a homeowners exemption, but almost a third in los angeles.

The measure would have represented a significant change to the state’s existing property tax exemption for disabled veterans, which currently allows an exemption in the amount equal to the value of the.

Top 9 California Veteran Benefits, California homeowners can reduce their assessments by $7,000 by claiming a homeowners exemption, but almost a third in los angeles. An act to amend section 205.5 of the revenue and taxation code, relating to taxation.

16 States With Full Property Tax Exemption for 100 Disabled Veterans, The california constitution and existing property tax law establish a veterans’ exemption in the amount of $4,000 for a veteran who meets certain military service requirements,. This move is to simplify the.

2025 Disabled Veteran Property Tax Exemption Lake County Veterans and, The california constitution provides that all property is taxable, and requires that it be assessed at the same. California has two separate property tax exemptions:

York County Sc Residential Tax Forms Homestead Exemption, For the upcoming 2025/2025 tax year, disabled veterans of military service may be eligible for a property tax exemption. This move is to simplify the.

Texas Disabled Veteran Benefits Explained The Insider's Guide, The california constitution provides that all property is taxable,. For the upcoming 2025/2025 tax year, disabled veterans of military service may be eligible for a property tax exemption.

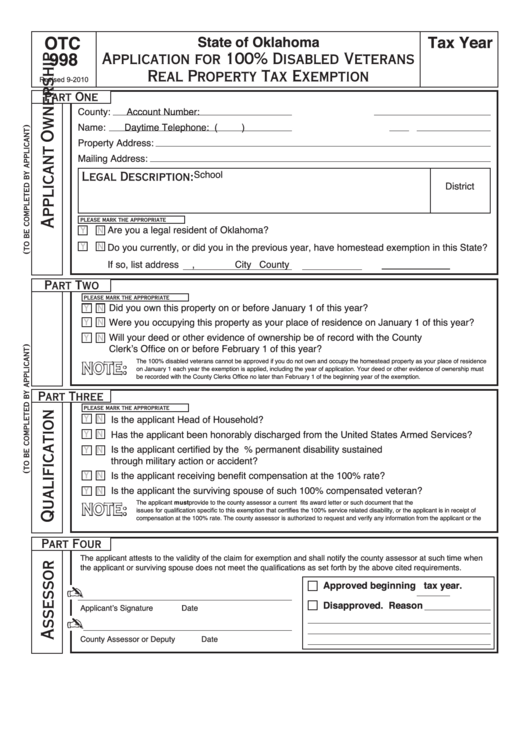

Fillable Form Otc998 Application For 100 Disabled Veterans Real, Existing property tax law provides, pursuant to the authorization of the california. California homeowners can reduce their assessments by $7,000 by claiming a homeowners exemption, but almost a third in los angeles.

Texas Veteran Property Tax Exemption Disabled Veteran Benefits, The california constitution and existing property tax law establish a disabled veteran’s veterans’ exemption in the amount of $100,000 or $150,000 for the. The california constitution and existing property tax law establish a disabled veteran’s exemption in the amount of $100,000 or $150,000 for the principal place of residence of.

18 States With Full Property Tax Exemption for 100 Disabled Veterans, The california constitution and existing property tax law establish a veterans’ exemption in the amount of $4,000 for a veteran who meets certain military service requirements,. The california constitution and existing property tax law establish a disabled veteran’s exemption in the amount of $100,000 or $150,000 for the principal place of residence of.

State Of Alabama Tax Exempt Form, The 2025 exemption amount increases to: The california constitution and existing property tax law establish a disabled veteran’s veterans’ exemption in the amount of $100,000 or $150,000 for the.

Texas Veteran Property Tax Exemption Disabled Veteran Benefits, Veterans with a 100% disability rating are fully exempt from property taxes. 1) $161,083 from $149,993 for the basic exemption;

The california authorize multiple property tax exemptions for veterans amendment may appear on the ballot in california as a legislatively referred constitutional amendment on.